Jaipur, the colorful capital of Rajasthan, is quickly becoming a budding financial services destination in Northern India. With its heritage appeal and vibrant business environment, Jaipur is experiencing a major uptick in banking, NBFCs (Non-Banking Financial Companies), NBFI (Non-Banking Financial Institutions), microfinance institutions, and fintech startups. Jaipur’s financial services industry contributes approximately 10% to the city’s GDP and is gradually pulling in investors and professionals eager to explore opportunities outside the traditional metro hubs.

As more businesses and individuals look for trusted financial partners, there is growing interest in discovering the Best Finance Companies in Jaipur. These companies are playing a pivotal role in shaping the city’s evolving financial landscape by offering innovative services, driving digital transformation, and supporting economic growth.

With Jaipur’s increasing digital adoption and government initiatives supporting entrepreneurship, the city is becoming a preferred destination for financial companies — including banks, fintech firms, NBFCs, and NBFIs — expanding their footprint in the region. This article explores why Jaipur is an attractive city for finance companies, profiles the top 10 finance firms operating in Jaipur, outlines the challenges faced, highlights career opportunities, and provides a helpful FAQ for aspirants.

Why Jaipur Is Growing as a Financial Hub

1. Competitive Location and Connectivity

Jaipur has excellent air, train, and road connections to major metropolises like Delhi and Mumbai.. Jaipur’s strategic location in Rajasthan also presents it as a natural hub for those firms that wish to address North and Western India’s financial market.

2. Emerging Talent Pool

With top-notch universities and institutes teaching courses in finance, commerce, and management, Jaipur graduates are highly skilled and capable of venturing into the banking and fintech industries. Its comparatively lower cost of living than metros also acts as a talent retention factor.

3. Increasing Digital Adoption

Government initiatives in Rajasthan to enhance digital payments, financial inclusion, and lending to MSMEs have sped up the use of fintech services in Jaipur, prompting firms to locate local operations.

4. Favorable Government Policies

The Rajasthan state government offers incentives such as subsidies, ease of regulations, and incubation facilities to financial startups, creating an environment favorable for the growth of financial companies.

5. Financial Awareness

Jaipur’s growing urban and semi-urban population has led to heightened demand for various financial products, ranging from loans to insurance and asset management, creating a rich opportunity for the providers of financial services.

Top 10 finance companies in Jaipur

1. AU Small Finance Bank

- Head Office: Jaipur, Rajasthan

- Market Cap: ₹15,000 crore (~$1.8 billion) (2025)

- Founded: 1996

- Rating: AA (CRISIL)

- AU Small Finance Bank :

https://www.aubank.in/

AU Small Finance Bank started as an NBFC in the business of vehicle finance and has successfully expanded into a full-fledged scheduled commercial bank. With its head office in Jaipur, the bank has become a leader in small finance, focusing mainly on underbanked and rural communities. AU uses a strong digital infrastructure to increase financial access and banking convenience. With its mobile banking apps, AI-powered loan approvals, and extensive ATM and branch network, it is the backbone of Rajasthan’s economic landscape. The Jaipur center acts as the operational, technology, and innovation center, spearheading financial inclusion efforts, customer outreach, and fintech collaborations to enable national growth.

Key Services:

- SME and car loans

- Retail and digital banking

- Microfinance and financial inclusion products

- Insurance and investment services

2. Shriram Transport Finance Company

- Head Office: Chennai, Tamil Nadu (Large Jaipur Operations)

- Market Capitalization: ₹20,000 crore (~$2.5 billion)

- Established: 1979

- Rating: AAA (ICRA, CRISIL)

- Shriram Transport Finance:

https://www.stfc.in/

Shriram Transport Finance Company is a leader in commercial vehicle financing and has a strong presence in Jaipur, where it has one of its largest regional offices. The company is renowned for financing small truck owners, first-time borrowers, and rural transport operators. Its operations in Jaipur consist of a large field agent network, tele-calling centers, and a regional loan processing unit. The branch utilizes data analytics, vehicle telemetry, and credit-scoring models to offer customized financing products in accordance with transport sector demands. Shriram Transport Finance simplifies the process of loan disbursement and combines digital services to make Jaipur’s logistics and transport sector grow.

Key Services:

- Financing for commercial vehicles

- Second-hand vehicle loans

- Digital onboarding and fleet tracking

3. Muthoot Finance

- Headquarters: Kochi, Kerala (Key Jaipur Branch)

- Market Capitalization: ₹34,000 crore (~$4 billion)

- Founded: 1887

- Rating: AAA (CRISIL)

- Muthoot Finance:

https://www.muthootfinance.com/

Muthoot Finance is the largest gold loan NBFC of India and has strong operational roots in Jaipur. The Jaipur branch is a key regional hub for gold-backed credit, digital loan processing, and app-based servicing. The branch is also used as a pilot branch for new-age services like online gold valuation and instant loan approvals. Muthoot Finance aims to empower individuals, small traders and businesspersons, and households who have lying gold assets. In Jaipur, the office serves as a center of digital product launches and community outreach initiatives, extending the reach of financial services to Rajasthan’s semi-urban and rural areas quickly.

Key Services:

- Gold loans

- Personal and vehicle loans

- Digital gold valuation

- Insurance and remittance services

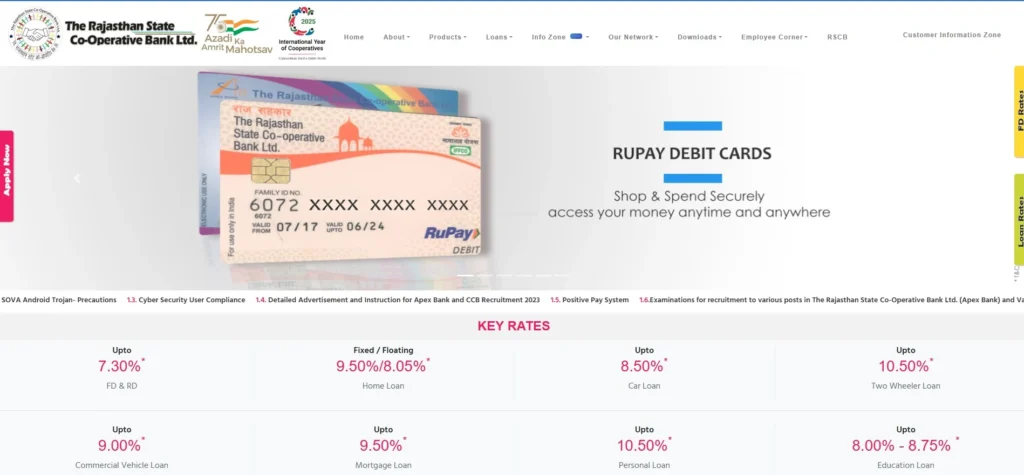

4. Rajasthan State Cooperative Bank (RSCB)

- Head Office: Jaipur, Rajasthan

- Formed: 1962

- Rajasthan State Cooperative Bank:

https://rajcrb.rajasthan.gov.in/

RSCB is a key player in Rajasthan’s cooperative banking system with a major emphasis on rural development and agri-finance. Being the apex cooperative bank of Rajasthan with its head office at Jaipur, RSCB coordinates finances among more than 5000 cooperative societies. Its aim is to provide credit to farmers, small-scale industries, and agro-allied industries at an affordable rate. Jaipur-headquartered head offices deal with policy planning, deployment of credit, and refinance arrangements. RSCB is also aligned with NABARD for development initiatives and invests in rural banking infrastructure digitization. The Jaipur branch of the bank is at the center of crafting and executing state-level financial literacy, crop insurance, and micro-saving programs.

Key Services:

- Agricultural loans

- Cooperative banking facilities

- Rural financial inclusion initiatives

5. Capital Float (now known as AXIO)

- Headquartered: Bangalore, Karnataka (Jaipur Operations)

- Valuation: $600 million (2024)

- Founded: 2013

- Capital Float (AXIO):

https://www.axio.co.in/

Capital Float (now known as AXIO) is a fintech pioneer that provides digital credit lines and BNPL (Buy Now Pay Later) solutions with a strong operational presence in Jaipur. It targets small merchants, e-commerce consumers, and individual borrowers for instant access to credit. Customer onboarding, fraud risk detection, and real-time credit decision-making are done from the Jaipur office. The firm leverages sophisticated AI algorithms to assess risk and is integrated with platforms such as Amazon and Flipkart to provide embedded credit services.Additionally, Capital Float’s presence in Jaipur strengthens its network of partners with regional MSMEs, increasing its market share in Rajasthan’s digital lending sector.

Key Services:

- BNPL services

- Digital business loans

- Embedded credit in retail

Suggested Read: Finance Companies In Mumbai

6. Bajaj Finserv

- Headquarters: Pune, Maharashtra (Well established in Jaipur)

- Market Capitalization: ₹1.2 trillion (~$15 billion)

- Established: 2007

- Bajaj Finserv:

https://www.bajajfinserv.in/

Bajaj Finserv is a diversified financial company that provides consumer finance, insurance, and asset management.The Jaipur office plays a significant role in the distribution of goods like health insurance plans, lifestyle loans, and EMI cards. With its high emphasis on customer care and technology adoption, the branch leverages AI-based customer analytics and mobile platforms to personalize loans. It caters to a broad customer base of salaried employees, small enterprises, and urban consumers seeking convenience and prompt disbursal. Bajaj Finserv’s Jaipur office also facilitates insurance counseling and wealth management services specific to Rajasthan’s proliferating middle class.

Key Services:

- Consumer durable loans

- Health and general insurance

- Digital EMI cards

7. HDFC Bank

- Headquarters: Mumbai, Maharashtra (Jaipur Branch)

- Market Capitalization: ₹10 trillion (~$120 billion)

- Established: 1994

- HDFC Bank:

https://www.hdfcbank.com/

HDFC Bank’s Jaipur branch offers a comprehensive range of banking services, ranging from personal loans to high-net-worth wealth management. The bank provides banking services to Jaipur’s urban, semi-urban, and commercial areas through a vast network of ATMs, relationship managers, and digital offerings. The bank uses predictive analytics and AI platforms to offer customized banking experiences and retain customer loyalty. Jaipur’s operations team handles corporate accounts, loan books, and facilitates digital transition initiatives in the state. The branch also organizes money awareness camps, particularly for women entrepreneurs and students.

Key Services:

- Retail and corporate banking

- Home, personal, and auto loans

- Wealth management services

8. ICICI Bank

- Headquarters: Mumbai, Maharashtra (Jaipur Operations)

- Market Capitalization: ₹6.5 trillion (~$80 billion)

- Established: 1994

- ICICI Bank:

https://www.icicibank.com/

ICICI Bank has a technologically advanced branch in Jaipur that deals in various banking and financial services like SME credit, investment opportunities, and retail banking. It is extensively engaged in the digitalization of financial operations, providing paper-free loan disbursals and online banking facilities. Jaipur regional operations are also pivotal in the rollout of new fintech collaborations and retail payment technologies. ICICI has been instrumental in upgrading the financial infrastructure in Rajasthan and has consistently worked on empowering MSMEs and promoting startup ventures in Jaipur.

Major Services:

- Digital and retail banking

- SME and personal loans

- Insurance and investment solutions

9. IDFC First Bank

- Headquarters: Mumbai, Maharashtra (Jaipur Branch)

- Market Capitalization: ₹1.5 trillion (~$18 billion)

- Established: 2015

- IDFC First Bank:

https://www.idfcfirstbank.com/

IDFC First Bank offers modern banking services focused on financial empowerment and affordable credit. Its Jaipur operations are famous for low-cost savings accounts, digital registration, and financial literacy programs. The bank has been appreciated for its ethical banking and customer delight approach. Jaipur operations involve MSME loans, personal finance counseling, and student-focused saving plans. IDFC First Bank’s digital banking platform consists of apps with live transaction monitoring, AI-powered chatbots, and safe UPI integrations.

Key Services:

- Saving and current accounts

- Personal and business loans

- Digital banking services

10. Rajasthan Microfinance

- Head Office: Jaipur, Rajasthan

- Established: 2008

- Rajasthan Microfinance: https://www.cmfraj.org/

Rajasthan Microfinance is an institutional-level organization offering necessary services to the poor and marginalized people. Founded in Jaipur, it focuses mainly on women entrepreneurs and self-help groups through small-ticket loans, savings schemes, and financial literacy training. The organization has a significant contribution to make in poverty reduction and women’s empowerment at the rural level in Rajasthan. It achieves the last-mile reach of financial services through collaborations with NGOs, state programs, and mobile banking centers. It also liaises with Panchayats and rural credit boards from its headquarters in Jaipur to reach out to remote areas.

Key Services:

- Microloans

- Financial literacy initiatives

- Insurance for the low-income group

Issues Confronted by Finance Companies in Jaipur

Though showing strong growth, finance companies operating in Jaipur encounter a number of challenges:

- Regulatory Compliance: RBI and SEBI regulations, particularly for fintech and NBFCs, are still challenging.

- Cybersecurity: Greater digitization has exposed companies to greater fraud and data breach risks.

- Talent Acquisition & Retention: Emerging talent in Jaipur is confronted with competition from metros as well as startups, leading to retention issues.

- Infrastructure Constraints: Transportation and real estate infrastructure continue to lag in comparison to major metros, directly affecting operational efficiency.

- Credit Risk: Handling NPAs and defaults, particularly in unsecured loans and microfinance, necessitates strong risk frameworks.

Career Opportunities in Jaipur’s Financial Sector

Financial Analysts: Market analysis, credit risk valuation, and financial modeling.

Loan officers: handle client service and loan processing and approval.

Compliance Specialists: Facilitating compliance with financial statutes and policies.

Fintech Developers: Developing apps and platforms for digital finance products.

Customer Relationship Managers: Managing client portfolios and advisory services.

Microfinance Field Officers: Grassroots loan facilitation and financial literacy.

Officer salary entry levels in Jaipur are usually ₹3-5 lakh a year, with middle-level and senior jobs drawing ₹10 lakh and more, backed by enhanced professional training and certification courses.

Conclusion

Jaipur is fast emerging as a major financial services hub beyond the traditional metro cities. With supportive government policies, strategic location, skilled talent, and rising digital adoption, the city offers a strong foundation for banks, NBFCs, microfinance institutions, and fintech firms. The presence of the Best Finance Companies in Jaipur further cements its position as a leading financial destination.

From established players like AU Small Finance Bank and Muthoot Finance to innovative fintech firms such as Capital Float, the Best Finance Companies in Jaipur are driving financial inclusion, empowering SMEs, and fueling economic innovation. Their efforts are transforming Jaipur’s financial ecosystem into a model for other tier-2 cities.

While challenges like regulatory compliance, cybersecurity, and talent competition persist, the Best Finance Companies in Jaipur continue to leverage digital banking and embedded finance solutions to maintain growth and attract investors.

FAQs

Q1: Why is Jaipur emerging as a key location for finance companies?

A: Jaipur provides strategic proximity, expanding talent pool, supportive policies, and rising digital penetration, making it suitably located for financial services.

Q2: How important are fintech firms in Jaipur’s financial landscape?

A: Yes, fintechs such as Capital Float are growing by leaps and bounds, facilitating digital payments and credit in the city.

Q3: What kind of financial services are in greatest demand in Jaipur?

A: SME loans, gold loans, microfinance, digital payments, and insurance are in high demand.

Q4: What are the challenges for finance firms in Jaipur?

A: Major challenges include regulatory compliance, cybersecurity threats, talent attrition, infrastructure shortages, and credit risk.

Q5: What are the career opportunities in Jaipur’s financial industry?

A: Job opportunities include financial analysis, compliance, loan processing, fintech development, and customer management with increasing salaries and training assistance.