Money management in business is just like health care, where daily attention must be focused on it. Proper management of finances will make your business prosper and flourish. This will help you make good decisions and power through money woes by adhering to the right financial management tips in business. These tips for financial management in a business assist you in maintaining your financial position, saving money to plan your future, and making your business prosperous. All business owners should know the following money basics.

Intelligent financial planning cushions the firm against the unknown challenges. It also assists your decision in spending and investments. The right financial management tips in a business will build a lasting success and growth foundation. Following practical tips for financial management in a business ensures stability and long-term prosperity.

Why Financial Management Matters for Your Business

Operating any business without financial management is like driving a motor car without opening your eyes. Proper business decision-making requires you to understand where the money that you are getting originates and where it ends up.

- Growth: Proper financial management will make your business grow as it shows how to invest your dollars sensibly.

- Survival: Correct money management keeps your business afloat and is able to secures you through the hard months and unforeseen obstacles in the future.

- Investment: Financial management assists you in planning the future and attaining attainable goals in business.

- Confidence: With good management of money, you have a sense of being more confident when making key business decisions on a day-to-day basis.

- Trust: Quality financial records generate confidence in the bankers, investors, and clients who are interested in doing business with you.

10 Essential Tips for Financial Management in a Business

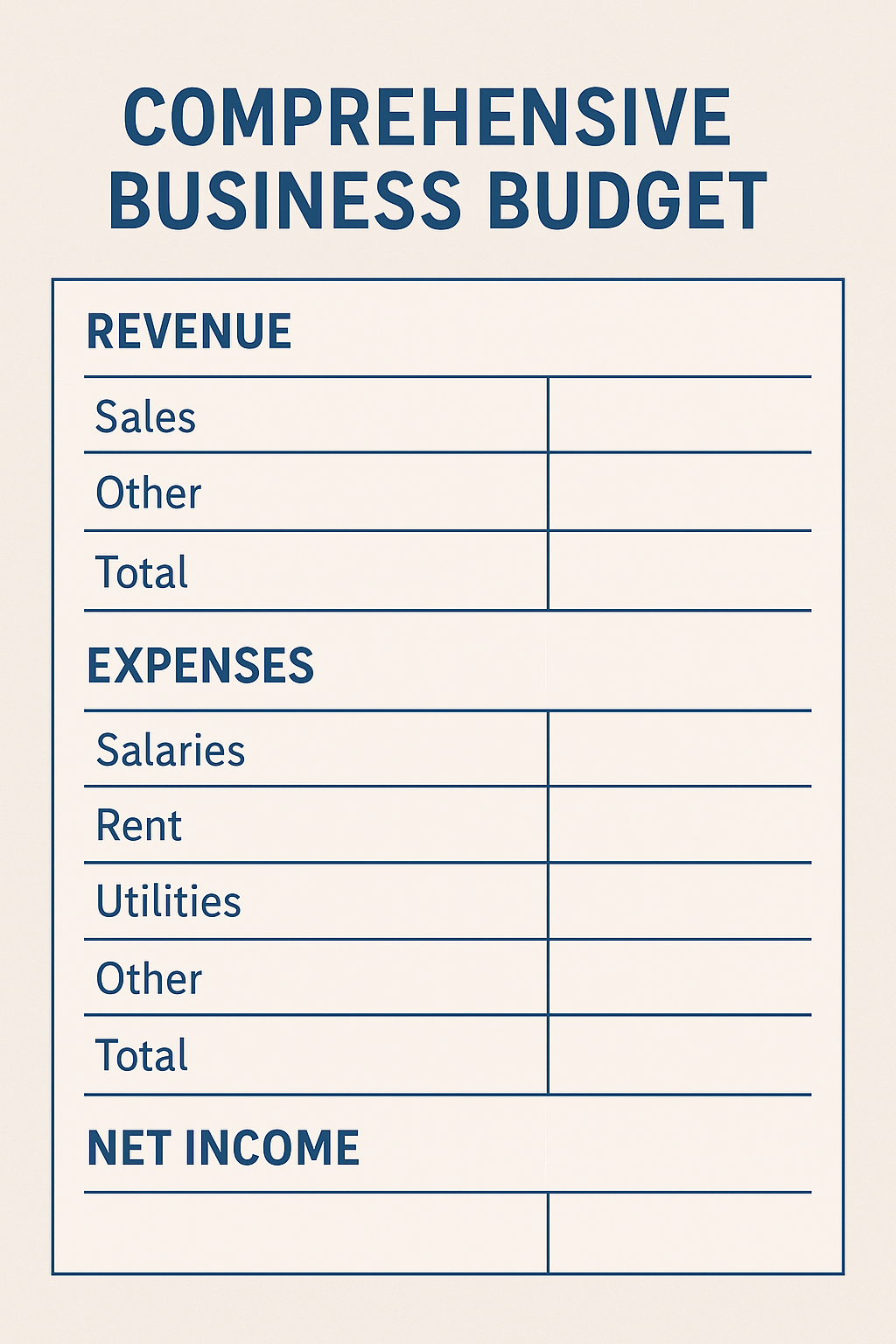

1. Create a Comprehensive Business Budget

One of the most valuable tips for financial management in a business is making a budget. A budget is a guide that can help you understand where you should spend your money. It also assists in making plans for how much income you will receive and the expenditures incurred by you on a monthly basis.

The results you should expect are based on how much should come in as income into your business, and therefore, write them all down. This encompasses money in the sale of goods or services. Write out how much you must spend. This involves the rent, supplies, wages of employees, and so on.

A good budget is to be dynamic. This implies that you can alter it in case things do not work out as intended. Occasionally, you will earn more than was foreseen. There are other occasions when you may incur surprise expenditure. The adaptable budget assists you in coping with such fluctuations.

Check your budget every month. Compare the fact with the plan. Are you spending more money than you had planned? Find out why and adjust the budget accordingly. Did you earn less money than you wanted? These are important tips for financial management in a business to help you stay on track.

2. Separate Personal and Business Finances

It is significant not to mix your own money and business money. That is one of the simple tips for financial management in a business, which many new business owners forget. When you intermingle some personal money with the business money, it is very difficult to know the expenses in the business.

Open another account that would only be used by the business. Use this account for business money only. You need to have all your business bills paid out of this account. Put in this account all the money your business earns

Take a business credit card as well. Use it to make business purchases. This simplifies the ability to keep track of business costs. It also acquires credit on behalf of your business.

At the time of tax filing, it is much simpler when there are different accounts separating lion’s shares of expenses. You may easily have all the income and expenses of your business. This helps you save time and money in preparing taxes.

Another factor would be to keep finances separate, which safeguards your personal money as well. Your money stays out of danger in case your business is facing monetary issues. This is extremely critical to business owners. It is one of the important tips for financial management in a business.

3. Implement Proper Bookkeeping Systems

Proper bookkeeping is to keep a diary of your business money. It is among the most applicable tips for financial management in a business. Bookkeeping is the act of recording all in and out activities of money in a business.

You may do bookkeeping manually in a notebook, yet doing it on the computer with the help of special programs is preferable. Software is less prone to errors, and it saves time. It also forms reports that guide you to know more about your business.

Write down all the business expenses immediately. Do not wait till the end of the month. Store all your received documents in a secure spot. Use a cell phone to capture pictures of receipts so that you do not lose them.

Good bookkeeping benefits you in several ways. It reveals to you the sections of your business that earn you the highest amount. It assists you in seeing where you are wasting money. It can also simplify tax preparation a lot.

Bookkeeping is considered a boring thing to many business owners, although it is important. It is up to you to decide whether you like or if you can employ a person to assist you. The funds you invest in bookkeeping assistance are worth it. These are helpful tips for financial management in a business.

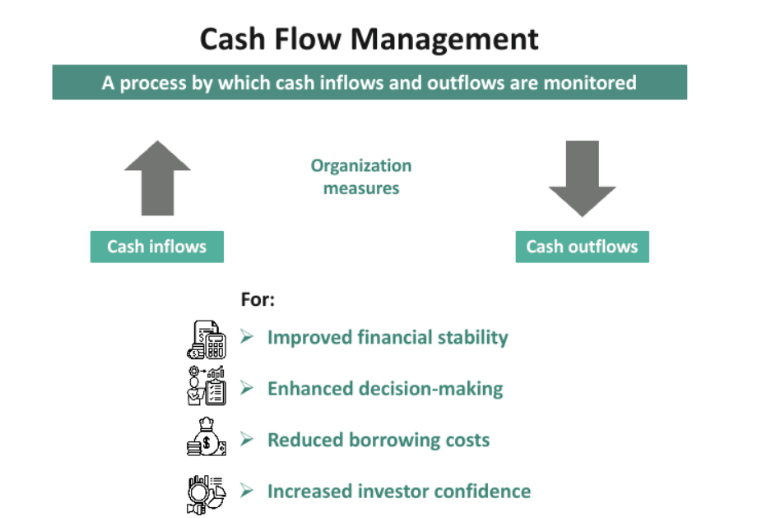

4. Master Cash Flow Management

Cash flow is the amount of money that is flowing into your business and that which is going out. The aspect of managing cash flow optimally is one of the most important tips for financial management in a business. Businesses may not be profitable, yet fail because of inappropriate cash flow management.

Monitor your cash flow weekly. Know your cash-in. Be aware of when to pay bills. This will enable you to plan and prevent bankruptcy.

There are cases of late payments by customers. This may result in a cash flow issue. As soon as possible, collect money from customers. Send bills immediately, Chase overdue payments. Consider giving discounts for early payment.

Always leave a little bit more money in your business account in case of an emergency. This assists you in paying bills even when customers are late in paying. It also assists you in making the most of good business opportunities when they arise. This is one of the essential tips for financial management in a business.

Plan for Slow Seasons. There are periods when lots of businesses do not earn as much money as they could. Save up during the busy periods to use it during the slow periods.

5. Understand Your Financial Statements

Financial statements are reports that depict how your undertaking is performing financially. The ability to read up on these reports is among the key tips for financial management in a business. The three primary statements used are the income statement, the balance sheet, and the cash flow statement.

An income statement demonstrates the amount of money your business earned and consumed within a particular period of time. It informs you about whether your business experienced a profit or a loss of funds. Read through this report after every month to establish whether your business is moving in the appropriate direction.

The balance sheet indicates what your business owns and what the business owes at a particular time. It consists of such things as cash, equipment, and debts. This report can assist you in viewing the general health of your business finances.

The statement of Cash flow illustrates the inflow and outflow of cash in your business. It is not like the income statement, where one does not need to deal with the money you receive or pay, but with the money you actually have and do not owe elsewhere. This is a crucial concept in tips for financial management in a business.

These reports should not scare you. As seen in the basic numbers. Ask questions in case you do not understand something. You can go a step further and have an accountant explain them to you.

6. Establish an Emergency Fund

An emergency fund is the money you put away in case of emergencies. Emergency funds are in list of the smartest tips for financial management in a business. Business has unexpected things that occur, such as the breakage of equipment, loss of a large customer, or economic crisis.

It would be lifesaving to have a business emergency fund of at least three to six months of business expenses. Don’t start big when you don’t need not. The saving of as small a sum as 100 dollars a month also helps. Keep this sum of money in another savings account so that you can avoid using it on other ordinary costs of running the business.

Use emergency money only in real emergencies. Do not use it to cover the normal business outlays or even to purchase new equipment unless it is almost essential. The presence of this cash ensures that you can sleep peacefully and therefore your business survives in hard moments.

Flexibility is also provided by an emergency fund. Good opportunities can be used without fear of not having enough money to cater to the regular expenditure. It is also easier to get good prices with suppliers when you have the cash. This is one of the key tips for financial management in a business.

It takes time to build an emergency fund, but it will be worth taking this step. Start now, a nd even with a little. Your future self will be appreciative when you need to pay an unexpected expense

7. Plan for Business Taxes Strategically

One of the best tips for financial management in a business is planning taxes. Numerous entrepreneurs are caught off guard by their final tax bill since it has not considered tax planning. Good tax planning will save your company a considerable amount of money.

Save on taxes during the year. You should not wait to tax time to think of this. As a general rule, one should set aside 25 to 30 percent of the profits as taxes. Put this money in a different account so as to resist the temptation to spend it.

Make excellent records of all costs of business. Several business expenses can decrease your taxes. These include things such as office supplies, business meals, traveling, and equipment. The better the records you keep, the more tax deductions you can make.

It is a good idea to enlist the help of a tax professional. They can point out legal methods of paying lesser taxes. They also ensure that you are following all the tax rules properly. Lower tax deduction means that the money you save can save you more in the future. This is one of the valuable tips for financial management in a business.

Learn about the timely payment of estimated taxes. Most businesspersons should pay taxes not once but 4 times in a year. Failure to pay on time may lead to fines and accrual of an interest rate.

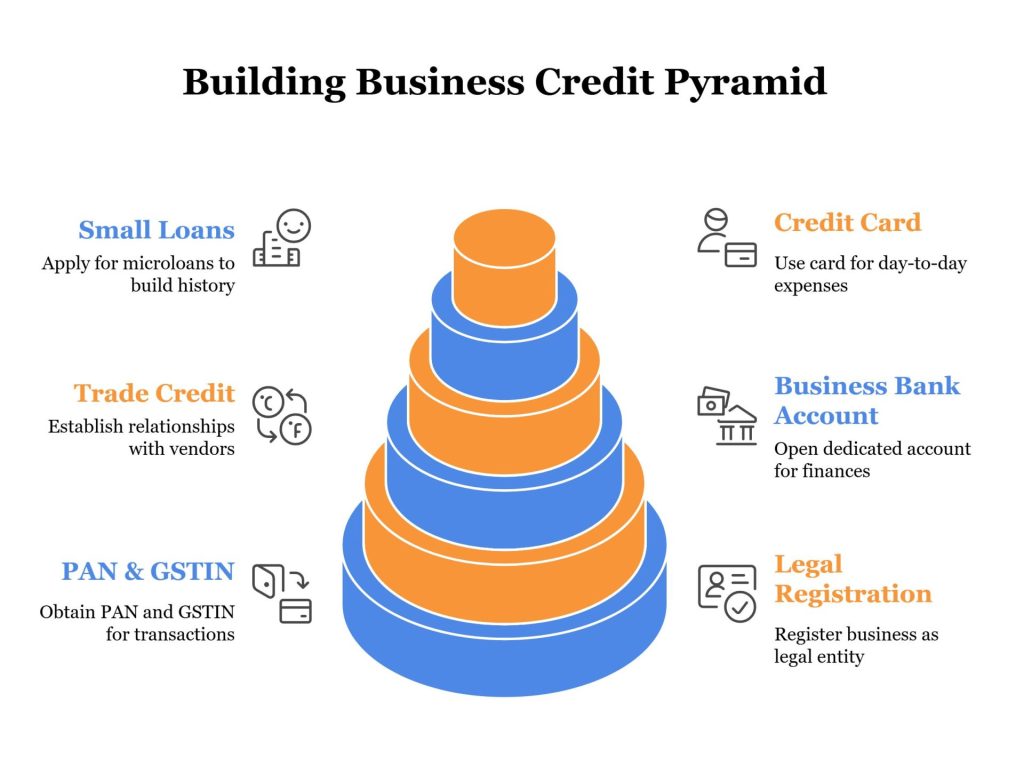

8. Build and Maintain Business Credit

One of the tips for financial management in a business that owners should not overlook is the need to build business credit. Good business credit can assist you in securing loans and lower interest charges, and better payment terms with vendors.

The first step you should take is to apply for a business license and a Business bank account. Put an application in for a business credit card and use it to make small purchases. Pay the bills as and when due. The most critical consideration in establishing valuable credit is the payment history.

Separate your business credit and your personal credit. This cushions your personal credit score as your business encounters financial problems. It also contributes to bigger loans in the future since the lenders can see your business credit history. This is one of the essential tips for financial management in a business.

Keep track of business credit. Correct errors and remedy the situation fast. Similar to a personal credit report, business credit reports can have erroneous data that will negatively affect your score.

Make sure to establish decent business credit, and this may take some time. It is possible you never need a loan now, but later you may need one. It is much easier to receive credit under the condition when you do not feel the critical necessity of it.

Read: Top 10 Finance Companies In Pune

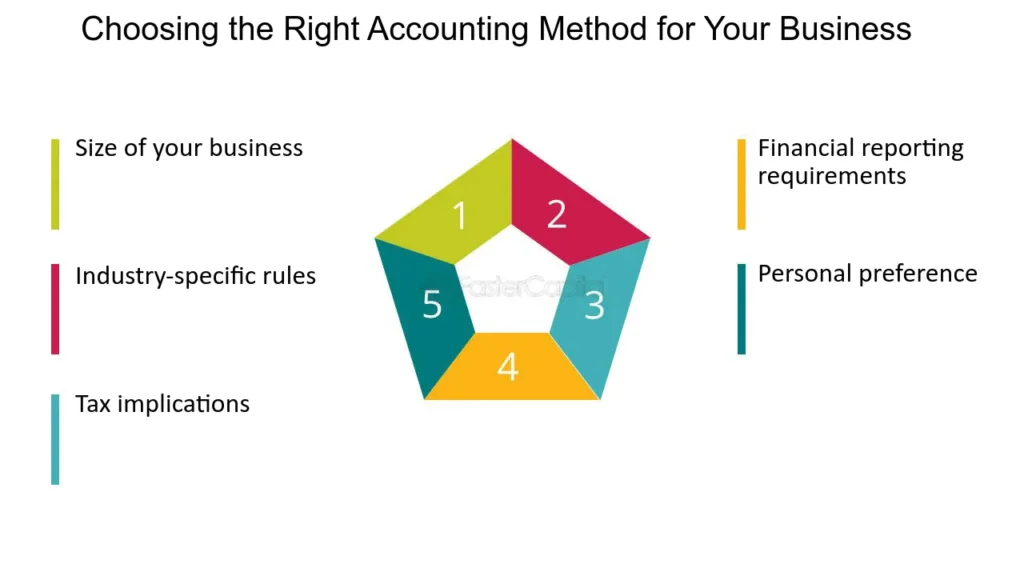

9. Choose the Right Accounting Method

Understanding how to select the correct method of accounting is one of the technical recommendations of tips for financial management in a business that influences how you monitor income and expenses. There are two major approaches, cash and accrual accounting.

Cash accounting is easier. You record income when you get money, and record expenses in case of paying bills. This is an acceptable approach to small companies with a fairly simple business process. It is less complicated and does not need a lot of writing.

Accrual accounting is more complicated and provides a more accurate reflection of your business. That is, accounting treats income as revenue when it is received and the expenses as incurred when references are made to costs, even though there has been no transfer of funds at that time. This approach is mandatory in the case of bigger businesses and also offers information that is more detailed on the aspect of finance.

The reason is that most small businesses begin with cash accounting. You may switch to accrual accounting in the future of your business growth. Consult with an accountant as to the most opportune technique to use in your business.

The accounting approach that you take influences your taxes and financial statements. Be sure you know the rules and apply them on a regular basis. Uniformity is quite critical to proper financial management. These are essential tips for financial management in a business.

10. Manage Business Debt Effectively

One of the most important tips for financial management in a business is to have an effective way to manage debt. Debt will enable your business to expand; however, excessive debt can also lead to major pitfalls. The trick is to get the equilibrium right.

Borrow only money that is going to enable the business to make more money. These can be items such as plants, stock, or moving to a new premises. You should not borrow money to run your daily expenditure, unless it is on an emergency basis. These are important tips for financial management in a business.

Compare rates on the various forms of loans before taking a loan. Check out the interest rates, payment terms, and fees. There are times when a loan that buys at a slightly higher interest rate has better terms attached to it. Read through all the paperwork and offer your signature after reading through it all.

Pay the debt on time. Missed payments damage your credit score, nd most often come with high penalty charges. Set automatic payments when this seems possible to avoid missing any due dates.

Have an idea of how to clear off debt. Be sure to make more than the minimum payment. Payments out of principal will save the interest cost and pay off your debt more quickly.

Refinance several debts into one payment in order to save money or to simplify the management situation. Yet beware of charging up balances once you have consolidated.

Read : 7 Days Loan App List in India (2025): A Complete Guide for Quick Cash

Common Financial Management Mistakes to Avoid

With good intentions, however, business owners may still make monetary slip-ups that can work against them. These are the typical mistakes that will teach you to better manage your finances in your corporate affairs.

- Mixing: Commingling personal and commercial money leads to misunderstanding and unnecessary time and effort in tax-filing.

- Putting off: When the delay occurred in addressing the financial problems, they have become more expensive to solve and tend to get complicated over time.

- Complacency: Neglecting cash flow and financial statements can cause major problems and the collapse of businesses.

- Excessive Purchases: Buying too much money on goods that are not necessary can steer away profits and cause the business to have poor cash flows.

- Underpricing: Pricing too low to attract customers can give rise to undercharging and incompetent business practices.

Conclusion

Every successful business is backed up by good financial management. These tips for financial management in a business can give you financial strength to succeed over time. Start with the fundamentals, such as budgeting and dividing money, and then gradually put in place more sophisticated means. It is important to remember that financial management is not a once-in-a-lifetime exercise but one that is continuous and must be looked into regularly. For more in-depth guidance, consider exploring resources provided by the U.S. Small Business Administration: Manage Your Finances.

The effort and time you would take to learn these tips for financial management in a business would be worth it, as the business would be performing better, there would be less stress, and more profits. Don’t wait to start applying these strategies in your business.

5 FAQs

What are the simplest tips for financial management in a business?

The first step is to make a budget, draw the line between personal and business funding, and introduce the appropriate bookkeeping systems to record all receipts and expenses. These are essential tips for financial management in a business.

What is the frequency I should use tips for financial management in a business to review my finances?

It is essential to review your finances at all levels, including weekly cash flow, monthly budget comparison,s, and quarterly full financial statement analysis and planning changes.

What are some of the tips for financial management in a business to avert cash flow issues?

Track cash flow, collect payments as fast as possible, have an emergency fund, and strategize on how to cover seasonal variations in your business revenues.

What are the key tips for financial management in a business for new owners?

The emphasis should be put on the issues of budgeting, differentiation of finances, the interpretation of financial statements, development of business credit, and taxation planning since the very first days in business. These are important tips for financial management in a business.

What are tips for financial management in a business to use in the case of an economic downturn?

Benefits of good financial management include having funds during a time of emergency, more control of cash flows, it also gives the company a minimal debt burden, and the ability can make better decisions based on the correct financial information.

Suggested blogs to read:

1. Top 10 AI Business Plan Generators

2. 10 Best Workflow Management Platforms for Teams & Projects