Effective management of business finances demands a powerful accounting solution that simplifies business processes and offers business insights. Although traditional solutions command the market, many companies are interested in finding the best accounting software alternatives that are more valuable, specialized, or responsive to their needs.

These options can revolutionize the way businesses manage invoicing, expenditure management, and accounts reporting. New or established companies, freelancers, or individuals all face the challenge of finding the right accounting solution in order to get business financial records and make better decisions.

What is Accounting?

Accounting can be defined as a procedure of recording, measuring, and communicating any financial information about an organisation or a business. It implies monitoring revenues, costs, assets, and liabilities in order to have a clear direction about the financial health. Contemporary accounting extends beyond the mundane accounting into financial planning, budgeting, and strategy.

Digital accounting programs have changed this field by automating the calculations, creating reports, and ensuring that the calculations are done in accordance with the tax regulations. The best accounting software alternatives come with powerful features, which make complicated financial processes easy and estimate the right idea on informed decisions in all business processes.

Why Best Accounting Software Alternatives are Important

The correct selection of the best accounting software alternatives can save a large part of your time and money spent on company efficiency and successful accounting implementations. Modern alternatives provide innovative solutions to common accounting problems, better user experiences, and customized functionality.

- Equalizes Cost-Effectiveness: Simultaneously, a huge number of other options are available with comparable qualities feature at a lower price point that can provide more value.

- User Experience: New updated payment forms in Best Accounting Software Alternatives focus on a user-friendly interface and a simplified procedure, creating a reduced learning curve for new customers.

- Specialized functions: Special solutions that incur specialized functions are provided with an aim of servicing one industry or model of business.

- The integration features: Sophisticated features in Best Accounting Software Alternatives are combined with other business tools, helping to provide a uniform workflow across the industry.

- Scalability: The Best Accounting Software Alternatives scale with you, offering flexible payment options and features that can be adjusted to meet growing business demands.

Key Features in Best Accounting Software Alternatives

The latest best accounting software alternatives integrate more complex capabilities to meet the modern business requirements, and at the same time not leave out the basics of accounting. These solutions are based on automation, collaboration, and real-time data access.

- Smart automation: Automated workflow eliminates manual data entry and the risks of human error in the finance process.

- Cloud Accessibility: Browser based applications can be accessed irrespective of any geographic location and enable a team to work remotely.

- Real-time Reporting: Real-time information on finances is also available which enables businesses to make informed and quick decisions using current data.

- Multi-platform Compatibility: All the bank, payment and business management tools plus any other tool can be easily integrated into systems.

- AI-Powered Insights: Sophisticated analytics and machine learning forecasts insights and pinpoints financial patterns without human input.

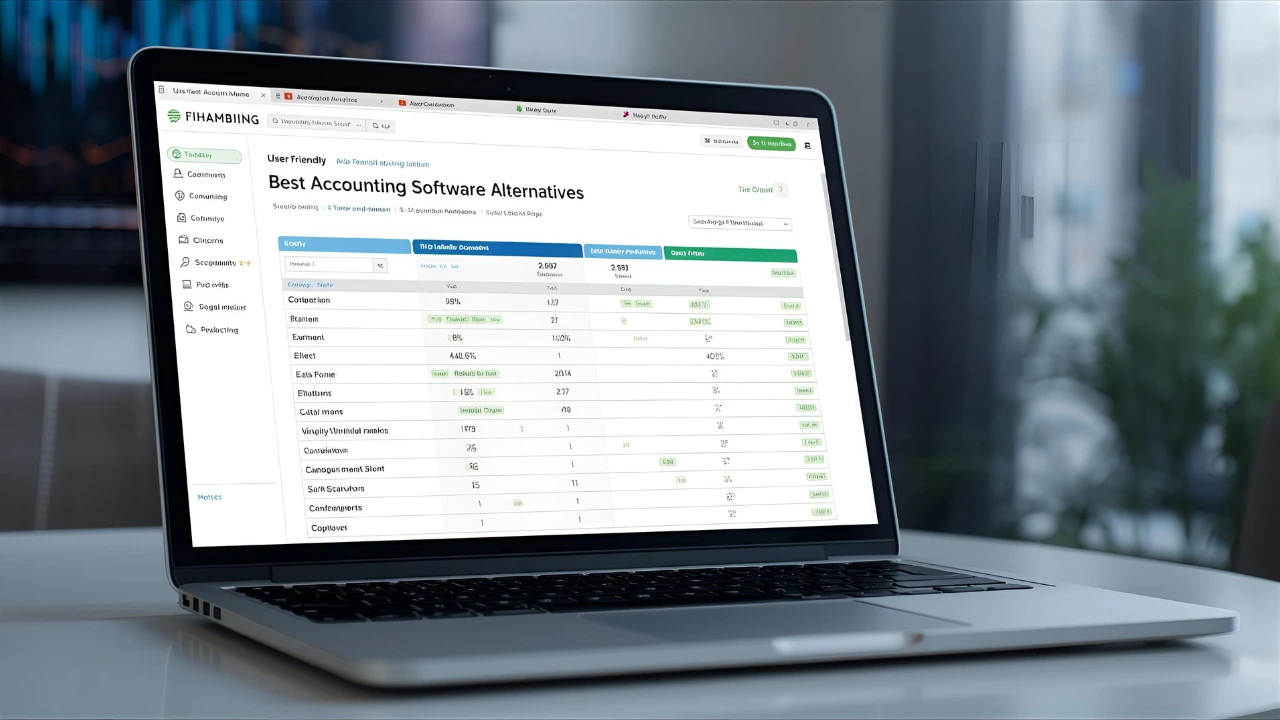

Comparison Table for Best Accounting Software Alternatives

| Software Name | Rating | Best Feature |

| FreshBooks | 4.8/5 | Freelancer-focused invoicing |

| Oracle NetSuite ERP | 4.6/5 | Enterprise resource planning |

| Zoho Books | 4.5/5 | All-in-one business suite |

| Xero | 4.4/5 | Project tracking integration |

| Wave | 4.3/5 | Completely free accounting |

| Sage 50 Accounting | 4.2/5 | In-depth reporting capabilities |

| Square | 4.1/5 | Social media selling |

| OneUp | 4.0/5 | CRM and accounting integration |

| Puzzle | 3.9/5 | Startup-focused metrics |

| QuickBooks Online | 3.8/5 | Real-time collaboration |

Top 10 Best Accounting Software Alternatives

1. FreshBooks

Rating: 4.8/5

Website: https://www.freshbooks.com/

Best Use Cases: Freelancers, small agencies, service-based businesses requiring customized invoicing

One of the best accounting software alternatives to consider, at least, among freelancers and small enterprises providing services, is FreshBooks. The platform strives to be easy to use without compromising on functionality, and the interface is bright and colorful, and immensely appealing to make financial management less daunting. It is strong on the ability to produce professional and customisable invoices at a much lower cost as compared to traditional solutions.

The dashboard offers a clear breakdown of investment data with its user-friendly navigation and integrates a comprehensive knowledge base. FreshBooks also simplifies project estimation with tools like a free estimate template available in formats such as Estimate Template for Word, PDF, and Excel, making it easier to create accurate quotes before billing. It excels in time tracking, expense management, and client communication, making it ideal for billing on an hourly or project basis.

Key Features:

- OCR receipt capture

- Multi-role user access

- Custom invoice templates

- Time tracking tools

- Client collaboration portals

Pros:

- Extremely user-friendly

- Affordable pricing structure

- Excellent customer support

Cons:

- Limited client capacity

- Higher cost per feature

- Basic reporting capabilities

Pricing: $40 + $6/per person each month

2. Oracle NetSuite ERP

Rating: 4.6/5

Website: https://www.netsuite.com/

Best Use Cases: Large enterprises, multi-location businesses, complex organizational structures

Oracle NetSuite ERP is the best accounting software alternatives when it comes to accounting software alternatives. This is a business-level software that incorporates accounting, CRM, e-commerce, and inventory into a system. NetSuite has highly advanced financial tools such as multi-currency, advanced revenue recognition, and planning modules. The platform can fit industries as different as retail and healthcare, and can be customized to workflows as well as to handle increased complexity in an organization. Its dashboard interface is balanced to offer simplicity of use and extensive functionality, letting the executive gain real-time insight into all operations of the business. Implementation is costly in terms of resources, but it has unmatched scalability and integration capabilities.

Key Features:

- Multi-currency support

- Revenue recognition management

- Custom dashboard creation

- Advanced financial planning

- Industry-specific modules

Pros:

- Comprehensive business integration

- Extensive customization options

- Oracle ecosystem support

Cons:

- Resource-intensive implementation

- Complex pricing structure

- Requires technical expertise

Pricing: monthly base package starting around $999

3. Zoho Books

Rating: 4.5/5

Website: https://www.zoho.com/in/books/

Best Use Cases: Growing businesses, companies needing an integrated business suite access

Zoho Books is one of the best accounting software alternatives that is particularly good when it comes to comprehensive engagement in a larger program. The software has powerful bookkeeping with the capacity to integrate projects, time and inventory. Although the interface can seem a bit cluttered at first, makes available extremely powerful customizing choices and ever more thorough input abilities. The budgeting apps of Zoho allow complex budgets to be generated in terms of capital assets and liabilities as well as equity. Reporting inputs are imaginable with a dazzling versatility and a preference in marking schemes. The eight version of payment gateways support, automated expense categorization of payment costs, marks out functionality in terms of business applications.

Key Features:

- Project time tracking

- Inventory management system

- Advanced budgeting tools

- Customizable report layouts

- Multi-payment gateway support

Pros:

- Extensive feature set

- Strong platform integration

- Flexible customization options

Cons:

- Overwhelming interface design

- Steep learning curve

- Complex navigation structure

Pricing: $49/month | $490/year

4. Xero

Rating: 4.4/5

Website: https://www.xero.com/

Best Use Cases: Project-based businesses, companies requiring detailed project financial tracking

What makes Xero stand out among the best accounting software alternatives is that it is equipped with an integrated project management component. The inclination of the platform to help businesses do beautiful business translates into its smooth interface and the well-designed project tracking system. Projects move through a draft, in-progress, and complete pipeline with comprehensive dashboards of estimates, invoices, expenses, and deadlines. In addition to project management, Xero has advanced bookkeeping, such as purchase orders, expense claims, and printing checks. Its comprehensive reporting capabilities and the integrated connectivity with hundreds of other applications make it especially useful to businesses facing numerous projects concurrently, with the need to control down to the financial aspect.

Key Features:

- Three-stage project tracking

- Purchase order creation

- Expense claim filing

- Comprehensive reporting suite

- Extensive app integrations

Pros:

- Intuitive user interface

- Strong reporting capabilities

- Native app ecosystem

Cons:

- Expensive project features

- Additional costs accumulate

- Limited basic plan

Pricing: Starter. $29. USD per month

5. Wave

Rating: 4.3/5

Website: https://www.waveapps.com/

Best Use Cases: Small businesses, startups, and companies prioritizing cost-effective accounting solutions

Wave is one of the best accounting software alternatives that breaks the traditional pricing model since core accounting and invoicing tools/functions are provided iteratively free of charge. Professional accounting is affordable to cost-conscious companies because this Canadian-American site charges issue-based payment processing rather than subscription fees. The user-friendly interface has curved fonts and simple icons, which give the user an interactive feel.

The Wave Checkouts solution would assist integration of payment on the web and the OCR would automatically extract customer payment details on the receipt of customers in paid plans. Bank account connectivity does not post orders to the bank, but instead securely pulls in all transactions, ensuring safety and integration of financial records through simplified data-entry capabilities to give complete financial control.

Key Features:

- Completely free accounting

- Wave Checkouts payments

- OCR receipt processing

- Bank account integration

- Cash flow visualization

Pros:

- Entirely free core

- Native payment processing

- User-friendly interface design

Cons:

- Limited geographic availability

- Payment processing fees

- Fewer advanced features

Pricing: $16 per month

6. Sage 50 Accounting

Rating: 4.2/5

Website: https://www.sage.com/en-us/products/sage-50/

Best Use Cases: Established businesses, companies requiring detailed financial reporting and analysis

Sage 50 Accounting unites decades of accounting experience with modern best accounting software alternatives, providing enterprise-level reporting functionality in businesses of all sizes. The strong point of the platform is its ability to show detailed reporting with the provision of more than 20 custom reports, such as audit trails, cash flow statements, etc. Sophisticated users can transfer data to Sage Business Cloud Intelligence to analyse and visualise in more detail. The dashboard provides detailed business reports with projections as well as monitoring bank accounts. Automated transaction categorization and document management capabilities, at premium price points, can hold great value to companies with high paperwork levels and an extensive need for detailed financial documentation.

Key Features:

- 20+ customizable reports

- Automated transaction categorization

- Document management system

- Business intelligence integration

- Cash flow forecasting

Pros:

- Enterprise-level reporting capabilities

- Established platform reliability

- Comprehensive feature set

Cons:

- Confusing pricing structure

- Expensive additional features

- Complex implementation process

Pricing: annual pricing starting at approximately $668/year

7. Square

Rating: 4.1/5

Website: https://squareup.com/us/en/software

Best Use Cases: Product-based businesses, social media sellers, companies needing payment integration

Square has long passed the mark of a simple payment processing tool and can become one of the best accounting software alternatives business can use to sell in various channels. The site is also strong in inventory management because it tracks inventory in real-time and enables customers to sell their goods within Facebook and Instagram.

Facebook Messenger integration makes it easy to communicate with customers without having to switch applications. The invoicing system provides quick, intuitive use, recurring invoices, various payment methods, and can be customized to look and feel like your brand. The advantage of Squire is that it is payment first, and it accepts credit cards, bank transfers, gift cards, and buy now pay later, and it provides point of sale hardware to physical establishments.

Key Features:

- Real-time inventory tracking

- Social media integration

- Facebook Messenger support

- Multiple payment options

- Point-of-sale hardware compatibility

Pros:

- Digital wallet support

- Seamless social selling

- Comprehensive payment options

Cons:

- Limited customization overall

- Commission-based pricing model

- Basic accounting features

Pricing: $79/mo. billed annually

8. OneUp

Rating: 4.0/5

Website: https://smallbusiness.oneup.com/accountant-software

Best Use Cases: Sales-focused businesses, companies integrating CRM with accounting functions

OneUp stands head and shoulders above the rest of the best accounting software alternatives due to its built-in incorporation of CRM and accounting features into a platform. The app is not very intrusive, and all features can be activated on an as-needed basis because the structure is modular. An intelligent search will allow navigating to the specific functions, e.g., creation of an invoice or viewing of a project.

The advantage of the platform is that it allows a connection between sales and financial data to follow leads, ongoing communication with a customer, and transactions, estimates, invoices, and project schedules. This can be a powerful integration in managing the coordination between sales and finance teams and offering end-to-end insight into revenues, such as initial contact to ultimate payout.

Key Features:

- Modular app structure

- Intelligent search functionality

- Integrated CRM capabilities

- Time tracking system

- Automated inventory restocking

Pros:

- Well-integrated feature set

- Excellent value proposition

- Clean interface design

Cons:

- Limited payment integrations

- Fewer third-party connections

- Basic reporting capabilities

Pricing: Plans start at $9/month

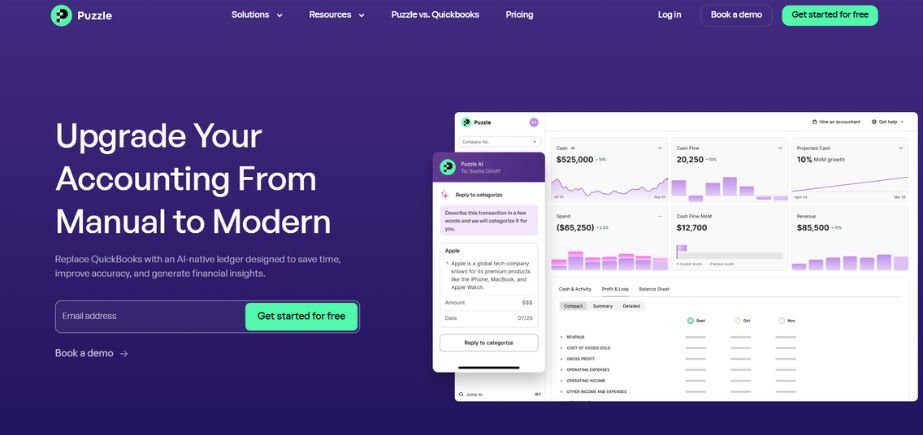

9. Puzzle

Rating: 3.9/5

Website: https://puzzle.io/

Best Use Cases: Startups, venture-backed companies, businesses requiring burn rate tracking

Puzzle is a new generation SaaS that is aimed specifically at the needs of the start-up community and concentrates on those metrics that are of most value to high-growth companies. Instead of generic financial reports, Puzzle focuses on burn rate analysis, cash balance tracking, and runway calculations that help conduct a fundraising process and make strategic planning. The Monthly Checklist feature walks through bank reconciliations, credit card checks, and assigning transactions, enforcing controls and order.

Financial Exploration tools offer in-depth insights into income, expenses, and payroll through various perspectives that facilitate quick optimization identification. This is best accounting software alternatives devoted to the entrepreneurship-driven process, and is strikingly different to the conventional accounting packages, in that it offers real-time decision support to resource-constrained developing businesses.

Key Features:

- Burn rate tracking

- Cash runway calculations

- Monthly compliance checklist

- Financial exploration tools

- Real-time decision metrics

Pros:

- Startup-specific features

- Chat-based accountant access

- Automated financial insights

Cons:

- Very niche application

- Limited general business use

- Fewer integration options

Pricing: starting at $349 / month

10. QuickBooks Online

Rating: 3.8/5

Website: https://quickbooks.intuit.com/global/

Best Use Cases: Remote teams, businesses requiring multi-user collaboration, and companies needing mobility

QuickBooks Online improves upon the classic QuickBooks experience of the best accounting software alternatives with a cloud and real-time collaboration focus. It is also the most flexible option as it allows remote working and operations spread across locations since a user can access it using any device connected to the internet. Individual logins can be created with customizable permissions to each of the team members, and accountant access eradicates any complications of file sharing.

QuickBooks offers powerful invoicing integrated with full accounting capabilities, ideal for growing businesses. For teams handling large invoice batches in spreadsheets or exports, SaasAnt Transactions adds an extra automation layer so you can bring those invoices into QuickBooks Online in one go instead of recreating each record manually.

The integration of Intuit Assist AI automates invoice creation, invoice reminders, and estimates. The ability to integrate with more than 650 applications can form complete business ecosystems, and the mobile-responsive design can provide consistency across the board among laptops, tablets, and smartphones to enable true business mobility.

Key Features:

- Cloud-based accessibility

- Multi-user collaboration tools

- Intuit Assist AI

- 650+ app integrations

- Mobile responsive design

Pros:

- Extensive support resources

- Strong integration ecosystem

- Real-time collaboration features

Cons:

- Feature complexity increases

- Higher costs than alternatives

- Overwhelming for simple needs

Pricing: $38 to $275 per month

How to Choose the Best Accounting Software Alternatives

In order to choose the best accounting software alternatives, it is important to examine your business carefully in terms of its current requirements, business expansion plans, and business processes. The correct decision can smooth the operations and give beneficial insights throughout the years.

- Business Size: Your team size and upcoming growth will likely have implications on the platform best suited to your needs, with some being able to expand larger teams at lower cost and others featuring more advanced capabilities around growth and collaboration, and administration.

- Industry Requirements: Determine whether you require industry or domain tracking features, such as project tracking, inventory management, a specific domain reporting, because some of the best accounting software options offer domain or industry-specific features to work and manage.

- Integration Needs: See what you already have and what integrations you may require that will ensure work processes run smoothly, data synchronized and there is no redundancy in data entry across tools.

- Budget Constraints: Companies are advised to calculate the cost of the complete ownership of the solution comprising of subscription costs, transaction costs, additional user costs and any probable integration cost so that the system will not become unaffordable to expand.

- Technical Expertise: Consider the technical expertise of your team and IT availability since some solutions are vastly more complex to implement, optimize and maintain than others.

Conclusion

The market of the best accounting software alternatives offers different tools to meet different business needs, and this includes tools used by freelancers and giant enterprise resource planning systems. Depending on the specific type of business need, cost effectiveness may be paramount, as with Wave, or specialized functionality such as Puzzle would be more appealing to the needs of startups, or the integration capabilities of NetSuite may be appropriate to satisfy the needs of large organizations.

Modern Betterness focuses on user experience, automation, and real-time collaboration in combination with the necessary accounting features. It is possible to determine the best accounting software alternatives by assessing important variables like the size of business, operational requirements of the industry, the degree of integration, and budget considerations that will enable a firm to not only address present needs, but also facilitate its business in the future and transform business needs.

Also Read: Best Project Management Software

Frequently Asked Questions

Q1. What are the cheapest effective best accounting software alternatives?

Wave provides complete free of charge core accounting features and Zoho Books and OneUp also provide an excellent value feature-rich package at a low price.

Q2: What are the best accounting software alternatives to be used by freelancers?

FreshBooks beats other services that can be used by freelancers because the company provides smart invoices, time management, client collaboration features that are designed with the preferences of service-based businesses in mind.

Q3 Do the best accounting software alternatives support multi-currency transactions?

Yes, packages like Oracle NetSuite ERP and Xero are effective in supporting multi currencies, have auto-convertible and compliant multi-currency features.

Q4: Which are the best accounting software alternatives that have the most robust mobile feature?

A4 Square, and QuickBooks Online have an intense mobile experience that has fully functional features on phones and tablets that make it possible to do mobile business.

Q5: Do the best accounting software alternatives integrate with more popular payment processors?

The majority of the alternatives on the market today connect to common payment gateways including Stripe, PayPal, and Square, among others with Zoho Books supporting as many as eight different payment gateways.